The draw back is you won’t acquire any tax deductions during your lifetime, and the charity received’t get anything right until When you die, which may be a few years absent.

creating a charitable remainder have faith in (CRT) might help with all your very own or your beneficiaries’ residing expenses, whilst they make tax savings and additional your charitable objectives. A CRT is definitely an irrevocable believe in that provides income to its beneficiaries for a specific expression of nearly a maximum phrase of 20 years or even the lifespan of a number of beneficiaries.

Understand Insights that you will need to itemize your deductions in order to attain a tax benefit. Ensure that when itemized, your whole deductions are increased than your common deduction. If they are not, stick to the normal deduction.

since the payment is actually a proportion from the balance, it could possibly fluctuate yearly dependant upon how the fundamental investments complete. (An annuity version of the charitable guide have faith in creates fixed yearly payments for that charity.)

By using the appropriate tax preparing approaches, charitable contributions can cut down 3 forms of federal taxes: income, funds gains and estate taxes.

The interior Revenue provider features a Exclusive new provision that will permit more and more people to simply deduct up to $three hundred in donations to qualifying charities this calendar year, even when they don’t itemize.

Estate tax procedures—The federal estate tax is usually a tax about the transfer of your respective house at your Dying. In 2024 the estate and gift tax exemption is $13.61M for each unique, so much less estates will probably be matter to this tax.

To qualify, contributions have to originate from a conventional IRA or Roth IRA, and they must be manufactured straight to a certified charitable Firm. In addition, the donor may well not obtain products or companies in Trade for the donation, and they must keep a receipt from Each and every charity to which a donation is built.

should you’re undecided no matter if a company is eligible for tax-deductible donations, it is possible to validate a company’s status from the IRS.3 2. you should itemize your deductions if you would like compose off charitable donations.

in case you make substantial charitable contributions, you may well be subject matter to yearly dollar ceilings on the charitable deductions. The ceilings are measured as percentages of your adjusted gross income (AGI), with decreased caps making use of to noncash presents.

The companies stated in Tax Exempt Firm research with foreign addresses are usually not international businesses but are domestically fashioned corporations carrying on functions in foreign nations around the world.

Not all charities acknowledge every type of residence. such as, quite a few deficiency the executive capacity to deal with sure Qualities, including private organization stock or artworks, that call for Exclusive valuations or appraisals.

Disclaimer: The above summary of specific federal income tax regulations is offered for informational purposes only. We urge you to definitely consult your tax advisor for the federal, condition, and native tax consequences of the charitable contribution.

money contributions around $250 need a composed acknowledgment from your charity that features the amount, whether or not the Group gave any items or solutions to your donor Using the contribution, and an estimate of the worth of any these kinds of goods or services.

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Destiny’s Child Then & Now!

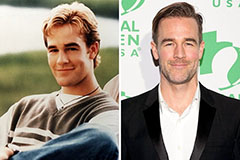

Destiny’s Child Then & Now! James Van Der Beek Then & Now!

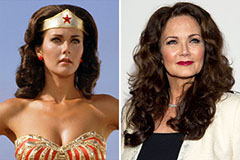

James Van Der Beek Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now!